We focus on early-stage investments, incubating and developing businesses from scratch; backing great management teams; exercising significant strategic involvement; remaining agnostic on control vs. non-control, with a requirement for significant influence.

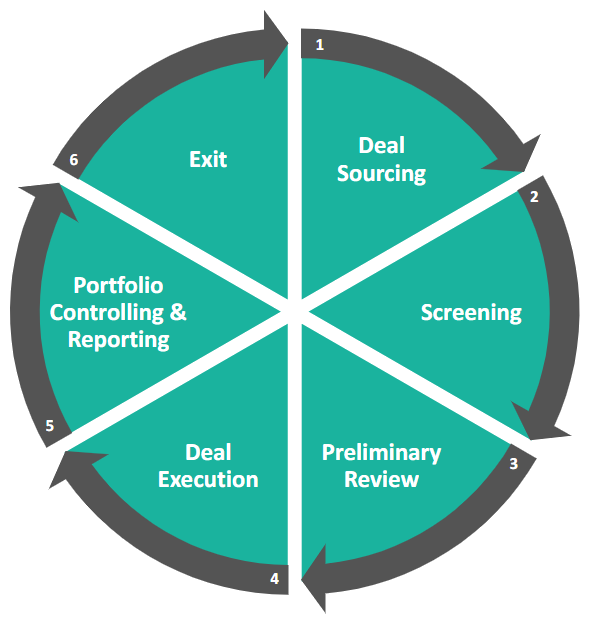

| Process | Timing | Main Activities | Tools / Documentation |

|---|---|---|---|

| 1 | Continuous |

|

|

| 2 | Continuous |

|

|

| 3 | 1 to 2 months |

|

|

| 4 | 5 to 8 months |

|

|

| 5 | 5 to 10 years |

|

|

| 6 | 1 to 3 months |

|

|